Gambia’s economy is expected to grow by 6.8 per cent in 2022, according to the finance minister, Mambury Njie. All sectors of the GDP are expected to register increased growth rates, indicating a bouncy and inclusive performance. The announcement came amid concerns that the country’s economic growth was tied to covid-19, Ukraine-Russia war and fears that the collapse of Thomas Cook Group could jeopardise efforts by one of Africa’s smallest countries to revive its fortunes.

Gambia, a $1 billion West African economy surrounded by Senegal aside from its access to the Atlantic Ocean, depends on tourism for nearly a third of its gross domestic product. Thomas Cook typically flew in 45 per cent of tourists that visited its white-sand beaches during the six-month peak season, according to official data.

“The GDP figures may be revised downwards because of Thomas Cook’s absence,” said Nyang Njie, an economist with consultancy firm Knowledge Bank Consortium Gambia. The country “doesn’t have time to adjust because the tourism season is starting,” he said.

The finance minister said the agriculture sector is estimated to grow from 4.5 per cent in 2021 to 6.3 percent in 2022. He said: “This increase is on account of the largest sub-component of agriculture – crops and forestry which are projected to record improved growth rates.”

Minister Njie further said the domestic revenue has been projected to increase to D17.6 billion compared to D13.7 billion estimated in 2021. He added: “This is a 16 per cent increase which is equivalent to D4.1 billion. Both tax and non-tax revenues are the sources of the increase as the government is improving efficiency of revenue collections and limiting the revenue loss through the granting of duty waivers.

“Total grants are projected to increase slightly by 2.3 percent from D12 billion in 2021 to D12.3 billion in 2022. The slight increase is due to a decline in programme grants as support that was received in 2021 for the Covid-19 pandemic would not be forthcoming in the coming year. This was however offset by a greater increase in project grants.”

Furthermore, he said as part of the government’s efforts for fiscal consolidation, total expenditure is expected to increase slightly by less than 2 per cent from D31.8 billion in 2021 to D32.2 billion in 2022.

“This is due to a significant decline in other current expenditures as much of the Covid-related health expenditure made in 2021 are not factored in the 2022 budget estimates,” he remarked.

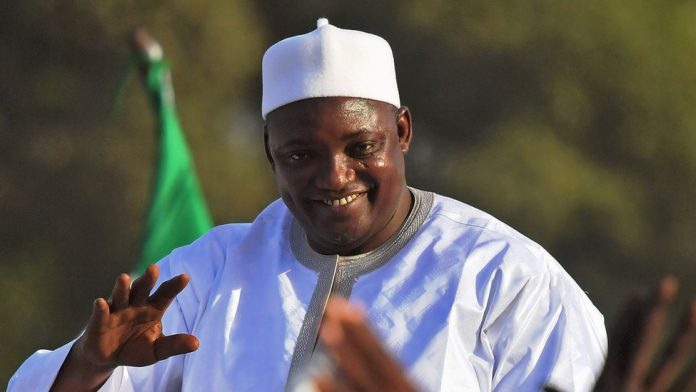

The Minister reminded the audience that prior to the global Covid-19 pandemic, the country had faced a wide range of political, social, economic, and environmental challenges.

“Yet throughout these challenges, the Barrow government continued to open the door of opportunities and launched much-needed reforms across all sectors of the economy,” Minister Njie said.

He also said these include macroeconomic and economic governance reforms, better management of the country’s natural resources, and the development of human capital.

“We also undertook reforms in our security sector while striving to harness the potentials of digitalisation, multilateralism, global trade, and data for development,” he said.

However, there have been concerns that with all these projections, the Gambia, being one of the countries with the highest debt in Africa, will struggle to meet its target. The country has over D88 billion domestic and international debt.

However, Momodou Sabally, a former banker and budget director, said: “Economic recovery for a country facing debt distress obviously starts with fiscal austerity; to restore the fiscal balance in order to cut down borrowing and reduce inflation stemming from deficit financing.

“Unfortunately, the Gambia government is doing the very opposite of that by implementing a massive 30 per cent salary increase that is sure to worsen the extant structural fiscal deficit. A disciplined central bank could be of help. But instead, the Governor of the central was on the front page of Standard a couple of months ago calling on commercial banks to lend to the government.”

Too much damage, Sabally added, has already been done to this economy.

“But a scaling down of public expenditure should help; and the central bank that was seen increasing their policy rate recently to stem inflation, should avoid being an accomplice to the current fiscal hinge of the Finance Ministry,” he added.